ADA Price Prediction: Bullish Momentum Targets $2.00 Amid ETF Buzz

#ADA

- ADA's price is trading above the 20-day MA, indicating bullish momentum.

- ETF speculation and strong holder confidence are driving market sentiment.

- Technical indicators suggest a potential breakout towards $2.00.

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

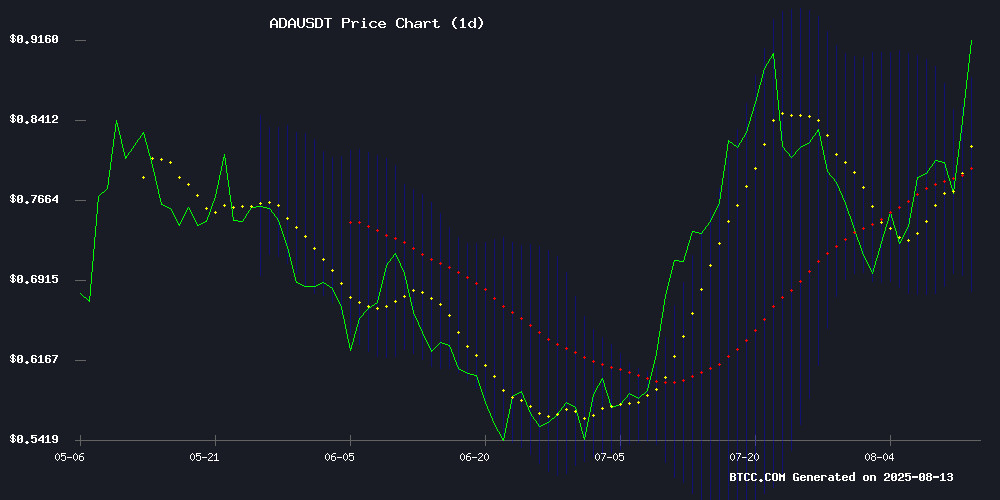

According to BTCC financial analyst William, ADA shows strong bullish momentum with its current price of $0.8856 trading above the 20-day moving average (MA) of $0.77945. The MACD indicator, though slightly negative at -0.008837, is converging towards a bullish crossover. Bollinger Bands suggest potential volatility, with the upper band at $0.871954 acting as resistance. A breakout above this level could signal further upside.

Market Sentiment: ADA Eyes $2.00 Amid ETF Optimism

BTCC financial analyst William notes that Cardano's price prediction of $2.00 is gaining traction due to ETF speculation and strong holder confidence. Despite recent profit-taking pushing ADA to $0.78, the long-term outlook remains robust. News of Grayscale registering Cardano and Hedera ETFs has further fueled bullish sentiment, aligning with technical indicators suggesting upward potential.

Factors Influencing ADA’s Price

Cardano Price Prediction: ADA Eyes $2.00 as ETF Buzz and On-Chain Strength Align

Cardano has surged back into the spotlight following Grayscale's registration for a potential ADA ETF in Delaware. While unconfirmed, the move signals growing institutional interest in the asset, fueling optimism among traders.

Technical indicators suggest a bullish trajectory, with ADA's V-shaped recovery from $0.76 to $0.83 breaking short-term resistance. Analysts now eye $1.00 as an immediate target, with $2.00 appearing achievable if momentum sustains through August.

The ETF narrative coincides with strong on-chain activity, creating a perfect storm for ADA's price action. Market observers note rising volumes and renewed confidence in Cardano's underlying technology as key drivers of the current rally.

Cardano Holders Defy Profit-Taking Trend Amid Market Rally

Long-term Cardano investors are accumulating ADA despite bullish market conditions and ETF speculation, signaling strong conviction in the asset's future. On-chain data reveals these holders have been steadily building positions since 2021, with distribution remaining negligible even as prices climb.

The loyalty appears rooted in ADA's current valuation—still 74.76% below its September 2021 peak of $3.09. This price memory effect creates psychological resistance to selling before recapturing former highs. Meanwhile, short-term traders show uncharacteristic restraint compared to their profit-taking behavior during the 2021 bull run.

Market heat indicators suggest ADA may be primed for another significant move. The divergence between holder cohorts paints a nuanced picture: veterans see current prices as accumulation opportunities rather than exit points, while newcomers display cautious optimism through measured position growth.

Cardano Retreats to $0.78 Amid Profit-Taking, Long-Term Outlook Remains Strong

Cardano (ADA) slid 5.28% to $0.78 as traders cashed in gains following last week's breakout above $0.80. The pullback comes after a 19% surge on August 9 that shattered key resistance levels, marking ADA's strongest performance in weeks.

Market dynamics suggest technical profit-taking rather than fundamental weakness. The rally was fueled by bullish momentum, including a 6% gain on August 8 and sustained buying pressure. Network fundamentals strengthened with the August 6 approval of a $71 million treasury allocation for core upgrades—equivalent to 96 million ADA.

Analysts remain optimistic about Cardano's trajectory. Crypto analyst Ali Martinez draws parallels to ADA's 2020-2021 structure, suggesting a potential $5 target in future market cycles. Technical indicators currently show mixed signals as the market digests recent moves.

Cardano Price Targets 130% Gains Amid ETF Buzz and Holder Confidence

Cardano's price surge continues as technical indicators and market sentiment align for a potential breakout. The asset now trades at $0.8764, testing key resistance levels that could trigger a mid-term rally toward $1.50-$2.

Grayscale's ETF filing for ADA and HBAR has injected fresh optimism into the market, contributing to a 14% intraday spike. Analysts highlight bullish signals across MACD, RSI, and CMF indicators, with traders watching for a confirmed breakout above July's peak.

Grayscale Registers Cardano and Hedera ETFs

Grayscale has filed to establish Cardano and Hedera Trust ETFs in Delaware, signaling a strategic expansion beyond Bitcoin and Ethereum. The August 12, 2025 registration precedes regulatory approval but underscores institutional demand for diversified crypto exposure.

The move reflects growing confidence in alternative layer-1 protocols. Cardano's peer-reviewed approach and Hedera's enterprise-focused hashgraph technology now join Grayscale's product pipeline, potentially unlocking new capital inflows.

How High Will ADA Price Go?

Based on technical and sentiment analysis, ADA could target $2.00 in the near term. Key levels to watch:

| Indicator | Value |

|---|---|

| Current Price | $0.8856 |

| 20-Day MA | $0.77945 |

| Bollinger Upper Band | $0.871954 |

| MACD Signal | Converging Bullish |